Recently, I’ve been working on a project that has grown beyond what anyone initially expected. What started as an attempt to revive an old product line inside the company many years ago has evolved into something much larger—a venture idea with its own potential, audience, and even the possibility of becoming a standalone IT company.

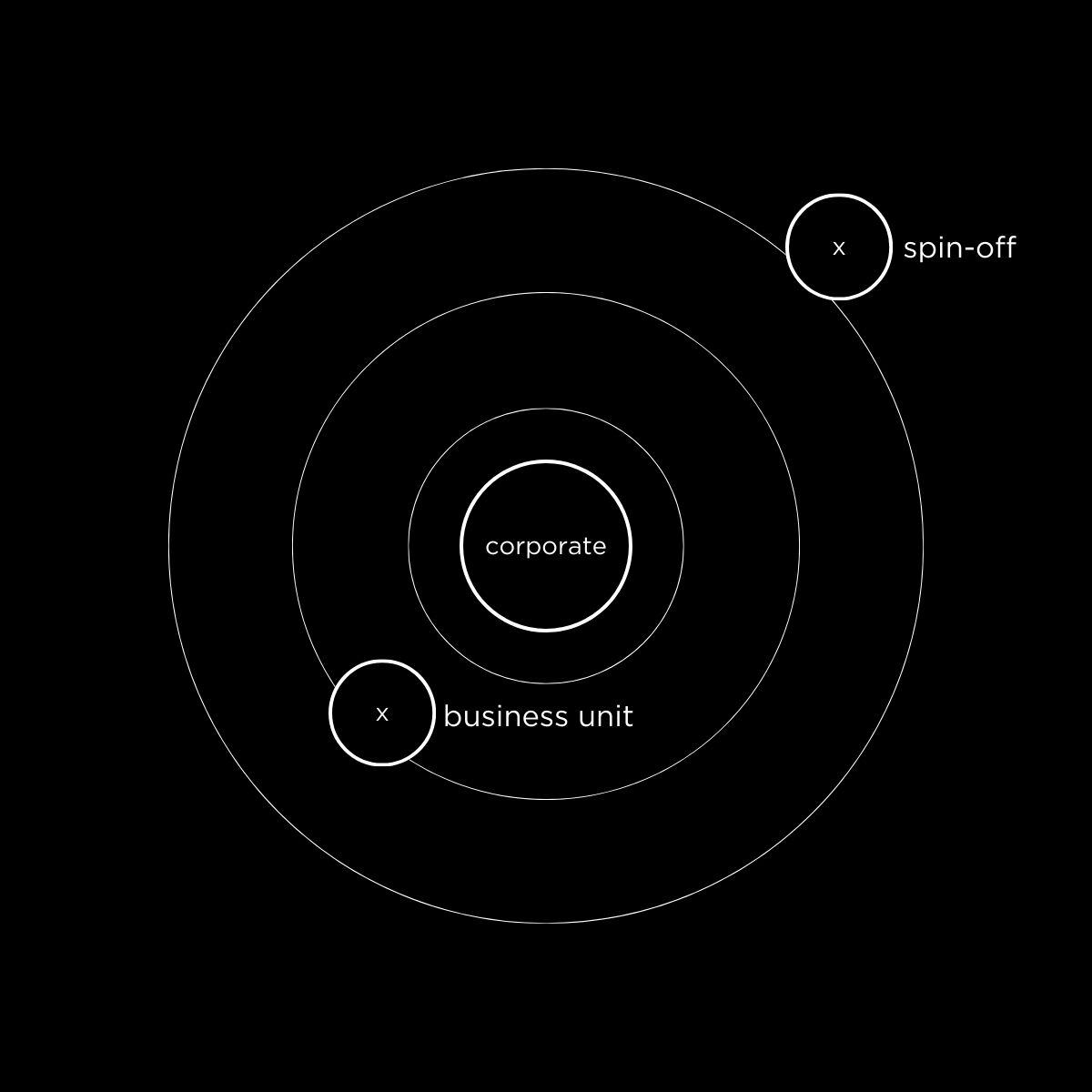

This transformation has raised an important question: Should this idea remain a part of the parent company as a business unit, or is it time to spin it off into its own entity? In Venture Deals, a book I read a few years ago, the authors highlighted that ownership essentially comes down to two critical factors: finances and control. These are at the heart of deciding how a venture should be structured. But of course, there are other factors at play, too.

One Insight from Me

First Things First: What's the Difference?

A business unit operates within the parent company’s structure, leveraging shared resources, branding, and leadership while staying aligned with the core business. Best practices agree, that this approach works best for ideas closely tied to the company’s existing capabilities, audience, and operations—typically suited for Horizon 1 to early Horizon 2 innovations.

A spin-off, on the other hand, is a standalone company with its own brand, leadership, and resources. This setup provides the autonomy needed to innovate and grow, making it ideal for ventures requiring a distinct culture, specialized skill sets, or a different market focus—often aligned with Horizon 2 to Horizon 3 innovations. In case you want to read more about what's what, here's a good resource to check out.

A Venture Case I’m Working On

So the company I’m working with now has traditionally focused on selling and managing physical products with a software component. Over the years, it has ventured into developing and implementing standalone software products. And the venture idea it's working on now is a fully-fledged IT Services company. As you can see, the new idea is not very dependent on the company's core. In fact, quite the opposite is true.

Therefore, this realization prompts an important question: Should this venture remain a part of the parent company, or is it time to spin it off into its own entity? Like many critical decisions, the answer isn’t straightforward. To tackle it effectively, we need to break the problem into smaller components and analyze them carefully to gain a clearer understanding of the bigger picture.

5 Key Perspectives to Consider

1 | Brand and Storytelling

Does the new venture align with the parent company’s brand? If it requires a distinct identity to truly connect with its audience, a spin-off might be the better option. However, if the parent company’s brand is strong and can effectively support the venture, keeping it as a business unit could make more sense. Great stories—and great branding—are inherently simple. The more complex the narrative becomes, the more it may signal that the venture needs to stand on its own, telling its own story.

2 | Team and Culture

Can the parent company’s existing team support the venture, or does it require a completely new set of skills and leadership? Generally, the more radical the idea and the greater its growth potential, the more resilience and entrepreneurial drive the team will need. This often means bringing in exceptional entrepreneurs—who typically thrive in autonomous environments rather than within the constraints of a business unit.

3 | Resource Allocation

Innovation requires significant resources—time, money, and leadership focus. While remaining within the parent company provides a safety net and access to shared resources, it can also limit the venture’s growth potential. That said, great entrepreneurs are risk-takers by nature. If safety is the priority, staying within the parent company makes sense. But if the goal is to build something transformative, it’s time to step out and chart a bold course forward.

4 | Market and Customers

Does the venture target the same customers as the parent company, or does it need to reach an entirely new market? The more radical the idea, the more likely it is that the venture won’t serve the same customer base. Existing customers often prefer incremental improvements, not something entirely new. Radical innovation typically demands a shift in focus toward new markets and audiences.

5 | Growth Potential and Risk

A spin-off allows for faster scaling, dedicated funding, and a higher valuation while isolating risk from the parent company. If you truly want to achieve significant growth, investment is essential. While a single company can act as the sole investor, it should not—doing so often limits the venture’s potential and is not advisable as an investment strategy for the parent company.

And Last but Not Least: Finances & Control

Who should financially benefit from the venture’s success?

A spin-off opens doors to external investment, leadership equity, and sharper focus on financial growth, but it also changes the dynamics of who shares in the rewards.

Who should control the venture to ensure it becomes financially successful?

The answer influences speed, agility, and strategic focus. Should the parent company retain influence, or should the venture operate with full independence under dedicated leadership?

Ultimately, the decision to keep the venture within the parent company or spin it off as an independent entity will shape its future trajectory. By carefully evaluating these perspectives, you can ensure the venture has the structure, focus, and resources it needs to thrive in an ever-changing market.

One Question for You

Have you ever been in a similar situation and if so, would you like to share your learnings with me and the community?

One Opportunity for Us

Over the last few months, I’ve been part of a team navigating these decisions, pushing to define a clear roadmap for next year. I know it’s a lot of work—spinning off a venture takes time, dedication, and careful planning. But it’s not something only large companies can do. I’ve actually worked with two SME clients in the past, who successfully spun off parts of their businesses to create clearer narratives and sharper focus.

If you’re wrestling with whether to spin off a venture or keep it close, let’s talk. Together, we’ll 1) Assess whether your idea fits your current structure or needs its own space, 2) Build a roadmap for spinning off, including brand strategy, team building, and market positioning and 3) Explore how to structure your next big move—whether you’re an SME or a corporate.