Let’s imagine your company has realized the importance of innovation and appointed you to lead the charge. Fantastic! But now comes the tricky part: explaining how innovation works to the rest of the organization. One of the first challenges you’ll face is educating stakeholders that the ROI from innovation projects isn’t always immediate or easily measurable. But despite this, innovation is essential for long-term growth and survival.

The critical question is: how much should your company invest in innovation, and what kind of innovation should those investments be directed towards?

As with most complex questions, the answer is: it depends. To help make sense of that, I’ve been diving into Aswath Damodaran’s work, which I first discovered on one of my favorite podcasts with Scott Galloway. His Corporate Life Cycle framework provides invaluable insights into how companies should think about their investments—including innovation—depending on their life stage.

One Insight from Me

Damodaran’s Corporate Life Cycle framework highlights that a company’s life stage directly impacts how and where it should invest. What makes his book so relevant to this discussion is the way he connects a company’s life cycle to its financial decisions, growth potential, and—most importantly—innovation strategies.

Here’s how the life cycle stages can guide your innovation investment strategy:

Startup Stage: At this early stage, companies need to focus on transformative innovations (Horizon 3). While resources may be tight, bold ideas are essential to lay the foundation for future growth.

Growth Stage: As resources increase, the focus should shift towards a combination of adjacent innovations (Horizon 2) and disruptive ideas to fuel expansion.

Mature Stage: Once your company reaches maturity, the priority should be core innovations (Horizon 1) to refine and optimize existing operations. However, it’s essential to still invest in adjacent opportunities to avoid stagnation.

Decline Stage: If a company is in decline, it might need radical changes. Here, investing in transformative innovations (Horizon 3) can either rejuvenate the business or open up entirely new opportunities.

General Investment Trends

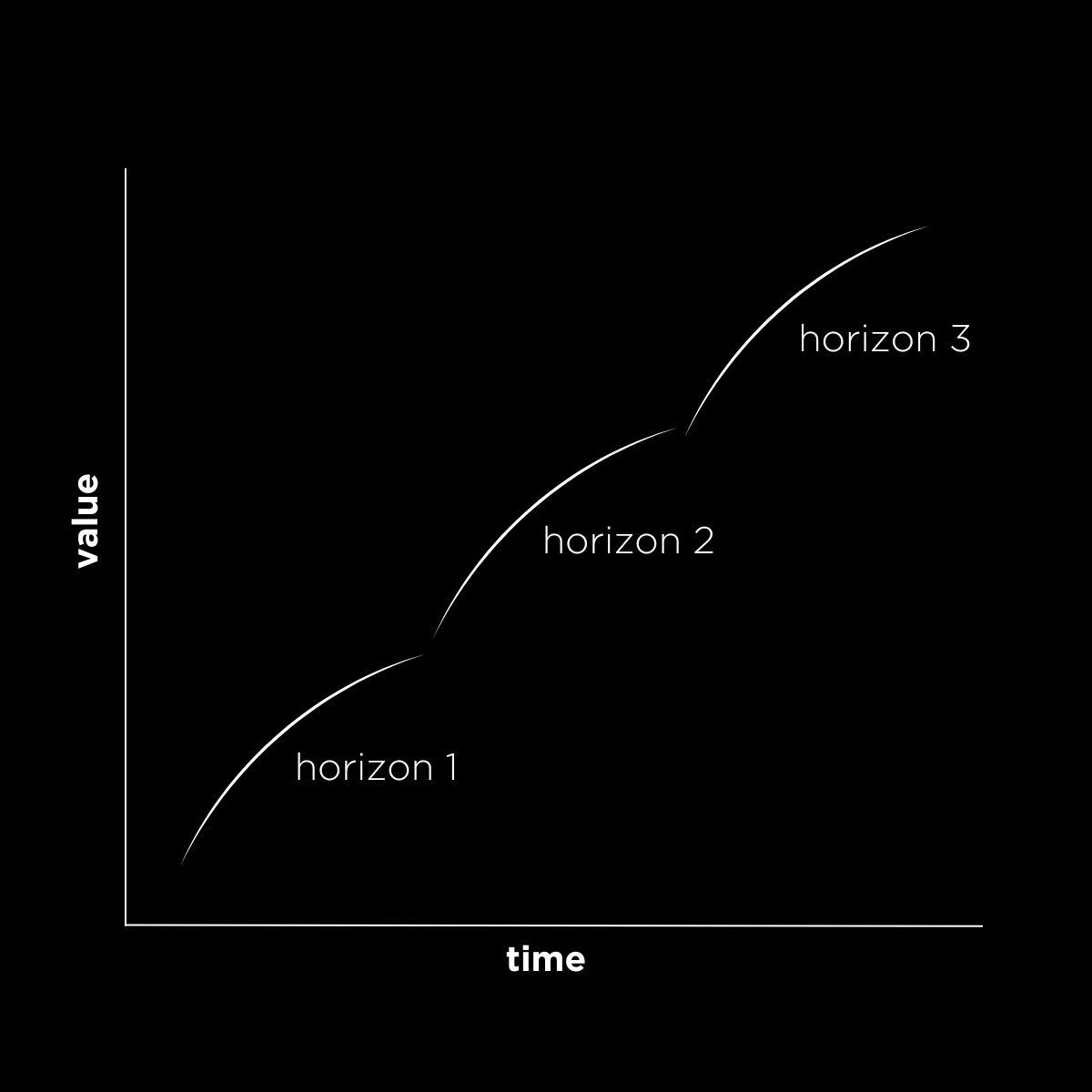

When it comes to overall innovation investment, companies typically invest about 3-4% of total revenue into innovation, although this number can be higher for industries that are innovation-driven, like tech and pharmaceuticals, where investment in R&D can reach up to 10-20%. Here’s a common strategy for allocating those innovation investments across the three horizons:

70% in Horizon 1 (Core Improvements) – focused on enhancing current products or processes.

20% in Horizon 2 (Adjacent Opportunities) – exploring related markets or new offerings.

10% in Horizon 3 (Transformative Innovation) – betting on disruptive, far-reaching ideas.

Of course, these percentages can vary based on your company’s stage and industry. For example, if you’re in a highly competitive, fast-growing sector, you might increase your investment in Horizons 2 and 3 to stay ahead. If your company is more established and focused on maintaining market leadership, a higher percentage in Horizon 1 might be the most efficient strategy.

Why Does This Matter?

Damodaran’s insights are critical because they help us understand that innovation is not a one-size-fits-all process. Your company’s life stage will determine how much you should invest and which type of innovation is most relevant. For example, a mature company with stable cash flow may focus on improving its core offerings, while a growing company will need to experiment with adjacent or disruptive innovations.

How to Tell Where Your Company Stands?

Figuring out where your company is in its life cycle involves asking key questions:

Is your company still growing, or has it leveled off?

Are your profit margins expanding or shrinking?

How agile is your organization when it comes to decision-making?

How open are your teams to change and new ideas?

Answering these questions can provide a clear sense of your current life stage, which in turn can guide your innovation investment strategy.

One Question for You

Where does your company stand in its life cycle? Are you investing in the right type of innovation based on your stage? Could there be opportunities to shift focus to align better with your current phase?

One Opportunity for Us

If you’re curious to explore more, I highly recommend checking out Aswath Damodaran’s Corporate Life Cycle framework. His book dives deep into how companies at different stages should manage their resources and innovate to stay relevant. It’s a great read, whether you’re leading a startup or managing a mature business.

For now, we can start by having a conversation about where your company stands. We’ll explore how to budget for innovation based on your specific life cycle stage, and I’m happy to challenge your thoughts on this.